Buying a home in Miami feels exciting. The weather, the neighborhoods, the lifestyle—it all moves fast. However, that speed is exactly where many buyers make one quiet mistake: skipping the house survey. At first, it seems harmless. The seller lived there for years. The fence looks straight. The driveway lines up. So why slow things down? Yet weeks or months after closing, regret sets in. Problems appear that no one mentioned. Neighbors start asking questions. Plans fall apart. And suddenly, buyers wish they had taken one extra step. This is why a house survey Miami FL buyers often skip becomes the thing they later wish they never ignored.

The Pressure to Skip “Unnecessary” Steps

In a competitive Miami market, buyers feel pushed to move quickly. Agents say surveys are optional. Lenders don’t always require them. Sellers want clean offers. As a result, surveys feel like an easy thing to remove.

However, removing a house survey doesn’t remove risk. It simply pushes that risk onto the buyer.

Many online homeowner forums are filled with stories that start the same way: “We thought everything was fine.” Then the problems begin.

The Fence That Was Never Yours

One of the most common regrets involves fences. Buyers assume fences mark property lines. That assumption causes more disputes than almost anything else.

In many Miami neighborhoods, fences were installed decades ago. They were placed based on guesswork, not measurements. When a new neighbor orders a survey, the truth comes out. The fence crosses the property line. Sometimes it’s inches. Other times, it’s several feet.

At that point, emotions rise. Neighbors demand removal. Landscaping gets destroyed. Legal letters follow. All of this happens because no one confirmed the boundary before closing.

A house survey would have shown this on day one.

Driveways and Side Yards That Come With Rules

Another frustration shows up with driveways and side yards. Everything looks normal until a homeowner tries to make changes. Then permits get denied.

Why? Easements.

Utility easements, shared access strips, and drainage paths often run through Miami properties. They limit what owners can build or change. Without a survey, buyers don’t see them. They only learn later, when a contractor refuses to proceed.

This leads to anger and confusion. Buyers ask why no one told them. The answer is simple. The information was always there. It just wasn’t reviewed.

Renovation Plans That Hit a Wall

Miami buyers love to improve their homes. Pools, patios, room additions, and outdoor kitchens are common goals. However, many of these projects require setback compliance.

Setbacks define how close structures can be to property lines. Without a survey, buyers guess. Unfortunately, guessing costs money.

Contractors often ask for a survey before starting work. That’s when problems surface. A patio already crosses a setback. A shed sits too close to a line. A pool design won’t fit legally.

At that point, redesigns cost time. Permit delays cost more. Sometimes projects get canceled altogether.

“The Lender Didn’t Ask for One”

This belief causes more regret than anything else.

Lenders protect loans. They don’t protect buyers. A mortgage approval doesn’t confirm boundaries, fences, or encroachments. It confirms financial risk.

Title insurance also has limits. Many policies exclude boundary disputes unless a survey exists. Buyers assume they’re covered. Later, they learn they aren’t.

That misunderstanding leaves homeowners exposed. A simple house survey could have filled that gap.

Why These Issues Are Common in Miami

Miami has unique factors that increase survey-related problems.

First, many neighborhoods have older lot layouts. Records don’t always match reality. Second, property turnover is high. The new owners don’t know the history. Third, redevelopment is constant. New construction brings scrutiny.

On top of that, coastal conditions affect land over time. Drainage changes. Shorelines shift. Assumptions fail.

Because of this, skipping a house survey Miami FL buyers rely on becomes riskier here than in many other cities.

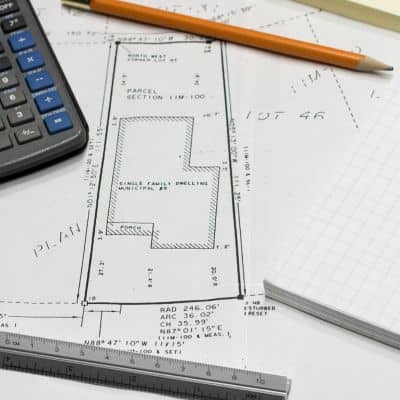

What a House Survey Actually Does

A house survey answers one simple question: What exactly do you own?

It shows property lines clearly. It identifies fences, walls, and structures. It reveals easements and access areas. It highlights encroachments before they become disputes.

Most importantly, it gives buyers confidence. Instead of guessing, they know.

That clarity helps with buying, planning, and selling later. It also prevents surprises that cause stress and conflict.

Regret Always Costs More Than Prevention

Many buyers skip surveys to save money. Ironically, that decision often leads to higher costs.

Fence removal costs thousands. Legal consultations add up fast. Permit redesigns delay projects. Lost resale value hurts long-term plans.

Meanwhile, a survey cost stays small compared to those outcomes.

The regret stories online follow a pattern. Buyers say, “We would have paid for it if we had known.”

Now they know.

The Question Every Buyer Should Ask

Before closing, buyers should ask one question:

What happens if I’m wrong about where my property ends?

If the answer feels uncertain, that’s the signal. A house survey isn’t paperwork. It’s protection.

In Miami’s fast-moving market, slowing down for clarity can save years of frustration. Buyers who learn from others’ regrets don’t repeat them. Instead, they move forward with confidence—and peace of mind.